Low Latency

BLISTERINGLY FAST, LOW-LATENCY REAL-TIME DATA FEEDS

CryptoIndexSeries real-time data network allows for geographically optimal collection and distribution of real-time data.

By collecting data for a given exchange as close as geographically possible to that exchange’s own infrastructure, we ensure low latency on the data collections side.

Our Partners may then connect to a WebSocket endpoint in the same location to consume that data.

"Our Real-Time infrastructure ensures we can deliver live data in the fastest time possible to our partners."

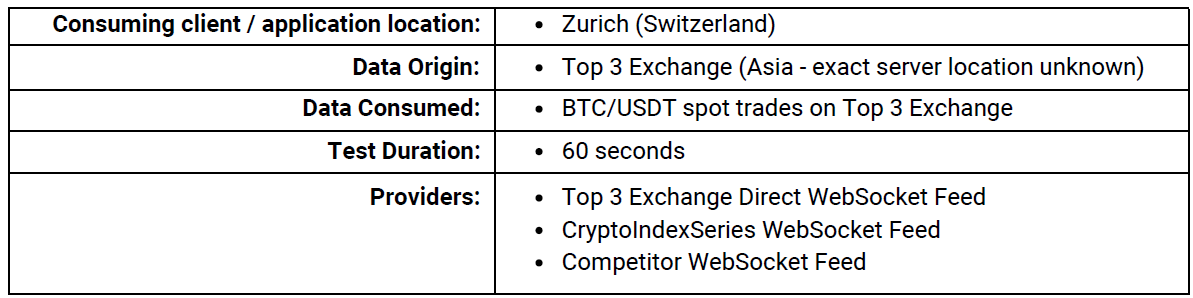

LATENCY TEST

“Provable, measurable low-latency real time data!”

We have tested and compared the latency of our normalised / consolidated real time exchange data to prove just how fast it is.

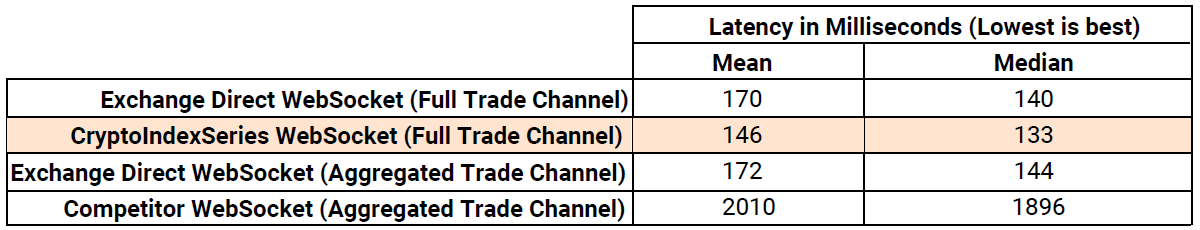

Results:

* Data was consumed concurrently with the timestamp of matching trades compared for latency

* Latency = Timestamp the trade was received – Timestamp of Trade

The results show that the CryptoIndexSeries feed has less latency than taking the same data from the Exchange WebSocket directly. This is quite an achievement and demonstrates the blistering speed of our real time infrastructure.

“The confidence that you have the fastest market data feed – priceless!”

For more detail on the above latency test or help conducting your own tests in your location feel free to contact us here - https://cryptoindexseries.com/en/contact-sales or contact@cryptoindexseries.com.

Data Coverage

REAL-TIME DATA COVERAGE

Currently we provide a single live data feed and distribute trade data and 24hour ticker data for every product on 30+ supported exchanges. For the full list of supported exchanges, please click here.

HISTORICAL DATA COVERAGE

Here are the current historical data coverage for different intervals:

| Interval | Coverage |

| Tick / Trade |

- 7 days ( Standard License) - Unlimited (Tick Archive License*) |

| 1 minute | 30 days |

| 5 minutes | 30 days |

| 15 minutes | 30 days |

| 30 minutes | 30 days |

| 60 minutes | 90 days |

| 1 day | Full |

* With access to our Tick Archive service, our partners can access years of raw trade and 1m candles (Please note that the start dates may differ by exchange for the data supported in the archive)

We're also adding market depth data for a select number of exchanges.

We also offer timeseries data via a single restful web API, this provides candlestick data for various intraday intervals as well as individual trade history should you need it.

SEARCH & REFERENCE DATA

In addition to the live and historical pricing data, CryptoIndexSeries also provides extensive referential data and search functionality to aid price discovery of digital assets across different exchanges / markets.

Exchanges have the following reference data:

- Native Symbol / CIS Symbol Mappings

Different exchanges use different symbols / symbology for assets and products. CryptoIndexSeries provides referential data to support an exchanges native symbology as well as our own standardised symbology - Product Lists & Details

Access a list of products per exchange along with relevant details such as the exchanges native product details plus a standardised trading info data model - Asset & Instrument Lists

Access a list of supported instruments & assets per exchange – very useful for cross-reference purposes.

For a more detailed data coverage document including fair price indices, market and sector indices, please click here.

Alternatively, you can contact us at https://cryptoindexseries.com/en/contact-sales or contact@cryptoindexseries.com.

Interested in learning more about Data Coverage in CryptoIndexSeries Products?