Institutional Adoption of Crypto Assets is Happening

Institutional Adoption of Crypto Assets is Happening

This article aims to present the clues proving the interest of Institutional Traders in Crypto Assets and how this interest will grow and bring in even a bigger crowd.

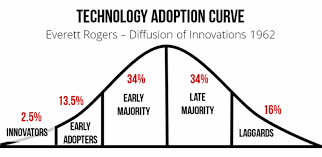

In the rest of this article, we refer to Everett Rogers’ 5 Customer Segments of Technology Adoption at his Diffusion of Innovations Theory in order to explain the current adoption level for Crypto Assets.

Here are some of the characteristics of these 5 segments of customers [1]:

- Innovators: Innovators are willing to take risks, are social and have closest contact to scientific sources and interaction with other innovators. Their risk tolerance allows them to adopt technologies that may ultimately fail. Financial resources help absorb these failures.

- Early Adopters: They are more discreet in adoption choices than innovators. They use judicious choice of adoption to help them maintain a central communication position.

- Early Majority: They adopt an innovation after a varying degree of time that is significantly longer than the innovators and early adopters.

- Late Majority: These individuals approach an innovation with a high degree of skepticism and after the majority of society has adopted the innovation.

- Laggards: They are the last to adopt an innovation. These individuals typically have an aversion to change-agents. Laggards typically tend to be focused on "traditions".

The development of Crypto Assets before the COVID-19 Pandemic and after the Pandemic can almost be labelled as B.C. and A.C. era for Crypto Assets.

During B.C. (Before COVID-19) era, Crypto Assets were mostly seen as part of a nascent technology. The technology itself, the immutable Distributed Ledgers, were promoted in many sectors to replace the traditional databases and perhaps also to automate the legal contracts with the help of smart contracts introduced after the infamous Ethereum project.

Between 2009 and 2014, the people in the scene were mainly the Innovators, who were trying to shape technology. They owned crypto assets not as an investment vehicle but mainly to lead the technology by example.

After the launch of Ethereum project, it became easier to create tokens (ERC-20 tokens). The number of crypto assets increased as well as the number of crypto exchanges. This meant more people had access to this technology and experimented in varying amounts. In fact, the Market Cap of Crypto Assets saw $820B at the end of 2017 and then witnessed huge drops. Between 2017 and Mar 2020, crypto assets built atop Blockchain technology were seen as volatile, risky instruments mainly ‘played’ by 3 types of customers:

- The whales (possibly innovators who owned huge amounts of assets as they possibly bought when the prices were less than $1)

- Small-size traders (Early adopters who saw an opportunity to gain more however much the risk)

- Forex-holders-turned-crypto-asset holders (Early adopters living in countries with high devaluation of the local cryptocurrency). This set of customers perceive crypto markets as an escape route to keep the value of their holdings.

In this article, I would like to label the March 2020 as the beginning of the A.C. (After COVID19) era for Crypto Assets. Although we have seen a huge drop right at the beginning of the Pandemic, the crypto assets have steadily become a safe haven for many. Due to economical challenges caused by lockdowns in many countries, the Central Banks have issued more money which result in the devaluation of the currency in many countries. Additionally, due to the nature of the Pandemic, many processes (including payments, transfers, etc.) have shifted to digital world which increased the interest to digital assets and digital payment solutions. Along side with this, the value of the crypto assets have increased since March 2020 and Bitcoin hit its historical record above $19,300.

All these events together with technological advancements (Digital Custodians, Crypto-Fintech Solutions) triggered Early Majority to join the Innovators and Early Adopters. Recent news about PayPal’s launch of their new service to enable their customers to buy/hold and sell crypto assets was almost an icing on the cake for the Early Majority customers justifying once again their arrival.

Early Majority group mentioned here are the Institutional Traders. 2020 has been the year of the institutional traders. Companies such as MicroStrategy, Square and Stone Ridge have all piled their money into assets like bitcoin and given new meaning to the crypto space. Institutional Investors Have Bought $429 Million Worth Of Bitcoin And Crypto Assets only during the second week of Dec 2020 and here are some news headlines from the last month presenting the acceleration (relevant links are given in the References):

- Grayscale Investments, the largest crypto asset manager, added roughly $100 million worth of Bitcoin and Ethereum to its investment portfolio. According to data circulating from crypto analytics firm bybt, on December 8th, Grayscale added 131,402 Ethereum worth approximately $74 million and 1,313 Bitcoin worth approximately $24 million on December 9th. Both acquisitions occurred over the course of two separate 24-hour periods. As of December 10th, Grayscale’s ETH assets under management (AUM) total $1.66 billion and its BTC AUM total $10.15 billion also according to bybt’s data. As of December 10th Grayscale’s own datashows that its AUM totals $12.2 billion.

- Prominent names as Paul Tudor Jones IIIand Stan Druckenmiller praised BTC and publicly admitted that they have allocated funds in it.

- The Wall Street giant Guggenheim filed a document with the SEC to purchase up to $500 million worth of bitcoin for one of its funds as well.

- The CoinShares report indicates that the total Assets Under Maangement (AUM) in the sector has reached an all-time high of $15 billion.

- James Butterfill, investment strategist at the digital asset manager, believes that the industry is only “on the cusp of institutional adoption. He states that “On an anecdotal level, based on our client conversations over the course of 2020, we have seen a decisive shift from inquiries of speculative nature to those that begin with comments such as, ‘bitcoin is here to stay, please help us understand it.”

- Michael Saylor, the chief executive of the world’s largest publicly traded business intelligence firm, is revealing how Bitcoin could meteorically rise by 100x from its current valuation.

- Investment icon Ric Edelman, named the nation’s top independent financial advisor by Barron’s three times over, the founder of Edelman Financial Engines, which has more than $200 billion in assets under management, says he is a believer and investor in cryptocurrency in a new interview with Real Vision.

- Massachusetts Mutual Life Insurance Company (aka MassMutual) recently purchased $100 million in Bitcoin. The transaction was facilitated by the New York Digital Investment Group (NYDIG). Insurance companies are known to avoid unnecessary risks and The 169-year-old insurance company buying Bitcoin may well be a sign that BTC is no longer a ‘risk-off’ asset. The firm invested only $100 million from its $239 billion investment account. While this is quite a small amount from the investment account, the institutional adoption by the firms have shown that there is more trust in the worth of Bitcoin than in previous years. The CEO of NYDIG has also said that there have been more institutional adoptions of BTC.

- SC Ventures, the innovation and ventures unit of Standard Chartered, will launch a crypto custody service targeting institutional investors in London next year. According to a Dec. 9 press statement, the British bank is partnering with U.S. wealth and asset management firm Northern Trust for the project. Together, they will launch a new business called Zodia Custody.

The deal is still subject to registration with the U.K. Financial Conduct Authority (FCA) and other regulatory approvals.

With the apparent adoption of Crypto assets by the Institutions, we expect to see more products addressing their needs and this was our starting point 2 years ago. We were perhaps able to foresee that institutional traders will be in need of institutional-grade data, tools and analytics in their decision-making processes. For this, we have created CryptoIndexSeries suite of tools.

At CryptoIndexSeries, we provide Crypto Market Professionals with the data, analytics and trading tools they require to effectively and efficiently carry out their duties and support their buy/sell-decision-making process.

In our products, we

- Collect Data from many sources

- Refine/Classify Data

- Normalise/Standardise Data

- Create new benchmarks

- Turn the findings into a meaningful/comparable/analysable form

Thus, the data collection, data analysis and decision-making process is shortened & optimised and made manageable potentially with less number of resources.

So, the focus of the Crypto Market Professionals can remain on building new investment strategies rather than having to deal with BIG data.

For more information on our products, please visit https://cryptoindexseries.com or you can always reach us at contact@cryptoindexseries.com

P.S. For those who are curious about what comes after ‘Early Majority’, here is my view:

Together with Institutions, the Challenger Banks and perhaps even some of the Traditional Banks (in the case of JP Morgan and Standard Chartered) will embrace the crypto assets and more services will be made available the mass public. Switzerland has been one of the countries (together with Estonia, Malta and Luxembourg perhaps) to experiment the use of crypto assets by citizens in daily life such as payment of tax, utilities, or services in cafes, etc. Once there are more crypto services available to the citizens in many countries, the late majority (the wide adoption) will follow.

Dr. E. Gökçe Phillips

14/12/2020

References

- https://en.wikipedia.org/wiki/Diffusion_of_innovations#CITEREFRogers1962_5th_ed

- https://newsroom.paypal-corp.com/2020-10-21-PayPal-Launches-New-Service-Enabling-Users-to-Buy-Hold-and-Sell-Cryptocurrency

- https://dailyhodl.com/2020/12/12/investment-icon-ric-edelman-owns-bitcoin-and-ethereum-says-xrp-is-part-of-technological-revolution/

- https://cryptopotato.com/institutional-investors-have-bought-429-million-worth-of-bitcoin-and-crypto-assets-in-a-week/

- https://dailyhodl.com/2020/12/13/michael-saylor-explains-how-bitcoin-could-surge-10x-to-100x/

- https://www.cryptopolitan.com/institutional-adoption-us-insurance-increase/

- https://www.livebitcoinnews.com/massachusetts-mutual-invests-a-ton-of-money-into-bitcoin/

- https://dailyhodl.com/2020/12/11/worlds-largest-crypto-asset-manager-just-bought-131254-ethereum-and-1313-bitcoin-in-24-hours/

- https://en.ethereumworldnews.com/bitcoin-is-no-longer-a-risk-off-asset-with-the-purchase-by-massmutual/

- https://news.bitcoin.com/standard-chartered-launch-crypto-custody-service-institutional-investors-next-year/