CIS Fundamental Analysis

VEGA Token Analysis

23/06/2021

What Does the Vega Protocol Do?

VEGA is a protocol for the creation and trading of marginalized financial products on a fully decentralized network. Secured by POS-PROOF OF STAKE, the network will facilitate fully automated, end-to-end margin trading and execution of complex financial products. Using the protocol, anyone will be able to build decentralized markets.

What Makes Vega Innovative?

Built-in liquidity incentives match traders and market makers in any financial product to solve the problem of attracting and allocating market-making resources, especially for long-term markets. Vega will connect to major blockchains for collateral that can be found in any digital asset, including Bitcoin, ERC20 coins and stablecoins, so participants can choose from a range of collateral options. Using a toolkit of product features and economic principles where all cash flows and payment orders can be easily determined, any participant can easily create and launch markets under a pseudonym.

What Are Vega's Goals?

It is Vega's mission to develop tools that guarantee freedom of trade and make that freedom accessible to everyone around the world. There are rules for rewards and incentives that stabilize the system, keep it fair, and help it grow.

What Does Vega's White Paper Say?

It explores how fully decentralized markets interact to collectively run them in a decisive way.

What is Vega's Impact on Derivatives?

Vega is developing a protocol that allows people to trade derivatives securely, on margins, and without surveillance. They make this possible by standardizing and automating every step of the trading lifecycle.

How is Liquidity Provided in Vega?

A key issue for exchanges is how to attract liquidity providers and maintain their support in all market conditions. VEGA develops mechanisms to create open, automated and scalable liquidity markets. Formal methods are outlined for measuring liquidity, setting its price, and allocating rewards from trading fees among market makers.

What is Atomic Margin Calculations in Vega?

The Vega trading engine uses industry standard risk models that optimize margin requirements for markets based on expected fluctuations and open interest. Each time a new block is created, the network recalculates margin levels to ensure traders get the most competitive leverage without compromising the safety of the markets.

Low latency and high current on Vega*

The Vega blockchain is optimized for commerce by design. It works with a block time of about one second and can process thousands of transactions per second. There is no charge for creating, cancelling or modifying an order. Instead, merchants only pay a fee when their order matches a buyer or seller, or for deposits and withdrawals from, for example, the Ethereum bridge smart contract.

Internal Liquidity Incentives at Vega*

Vega implements a new liquidity mining mechanism where liquidity providers (LPs) bid against each other to set the trading fee in each market. This not only leads to lower fees in highly competitive markets, but also sufficiently encourages liquidity in newer markets with lower volume.

Protective Tenders and Price Tracking*

The Vega network has created circuit breakers to ensure that trade takes place within safe limits. For highly leveraged lots, large price movements can lead to insufficient margins to close their open positions.

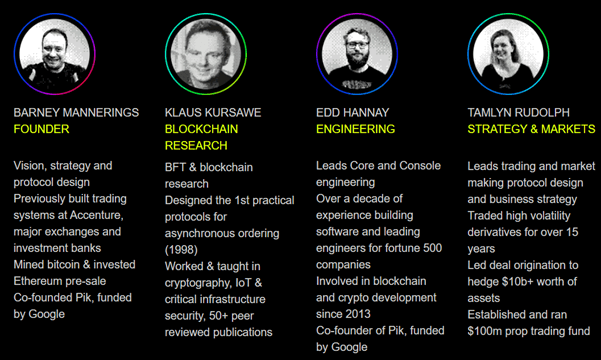

Team

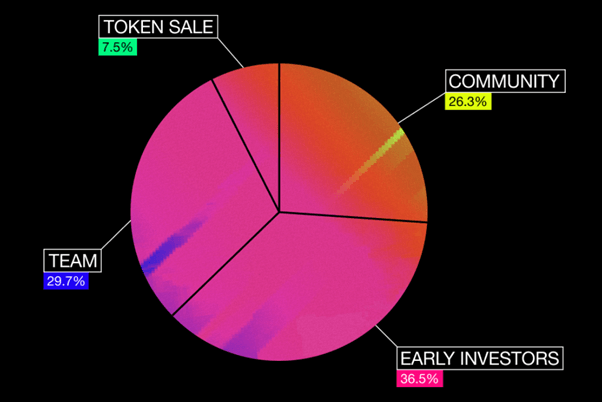

Tokeneconomics

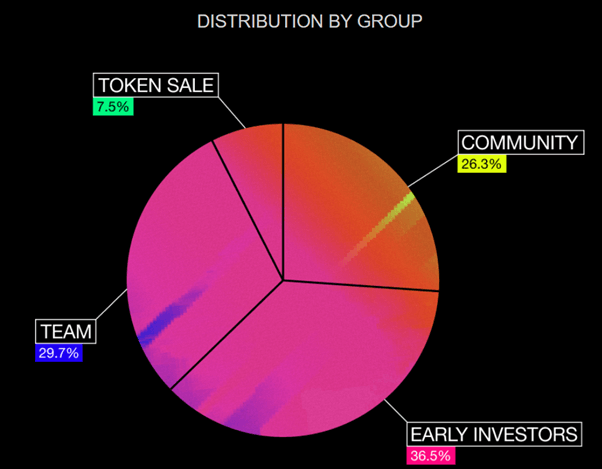

Token Distribution Schedule

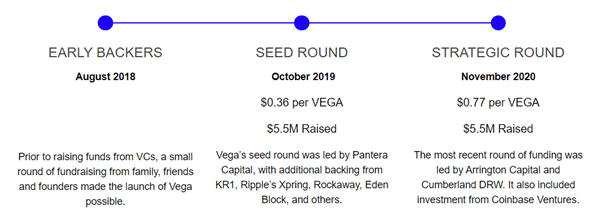

Funding Schedule

Backers

For more data, tools, analytics and news on Crypto Markets, register CryptoIndexSeries on cryptoindexseries.com

LATEST CIS GAZETTE ISSUES