CIS Price Analysis

Avax / US Dollar Analysis (Avax/USD)

18/05/2021 18:00 UTC

|

Price / Performance Summary |

|

|

|

|

|

Price |

$36,43 |

|

High |

$32,87 |

|

Low |

$37,56 |

|

|

|

|

7 Day |

4,7% |

|

30 Day |

6,8% |

|

3 Month |

0,9% |

|

6 Month |

900,8% |

|

242 Days |

590,0% |

|

Simple Moving Averages (d) |

||

|

|

Value |

Action |

|

10-d |

35,690 |

HOLD |

|

20-d |

34,820 |

HOLD |

|

30-d |

31,650 |

HOLD |

|

50-d |

31,630 |

HOLD |

|

(6,21)-d |

(35,62-34,51) |

HOLD |

|

Exponential Moving Averages |

||

|

|

|

Action |

|

10-d |

35,410 |

HOLD |

|

20-d |

34,370 |

HOLD |

|

30-d |

33,480 |

HOLD |

|

50-d |

32,160 |

HOLD |

|

Simple - Exponential Moving Averages Pairing |

||

|

14-d |

(36,17-35,04) |

HOLD |

|

Oscillators (d) |

||

|

|

Value |

Action |

|

RSI (14) |

53,75 |

HOLD |

|

MACD (12,26) |

(1,426-1,595) |

SELL |

|

CCI(14) |

49,1 |

HOLD |

|

Bollinger Bands |

N/A |

HOLD |

|

Chande Momentum Oscillator |

-9,53 |

HOLD |

|

DEMA(20,50) |

(36,23-35,035) |

WEAK SELL |

|

Stokastik Oscillator (14,3,3) |

(41,68-41,68) |

WEAK SELL |

|

Average True Range |

5,54 |

WEAK BUY |

|

Chaikin Osilatörü |

-1,417 |

SELL |

|

Detrended Price Osilatörü |

6,93 |

HOLD |

|

Volume-Demand Oscillators (d) |

|

|

|

Demand Index |

0,108 |

HOLD |

|

Money Flow Index |

58,07 |

HOLD |

I. Trend Analysis

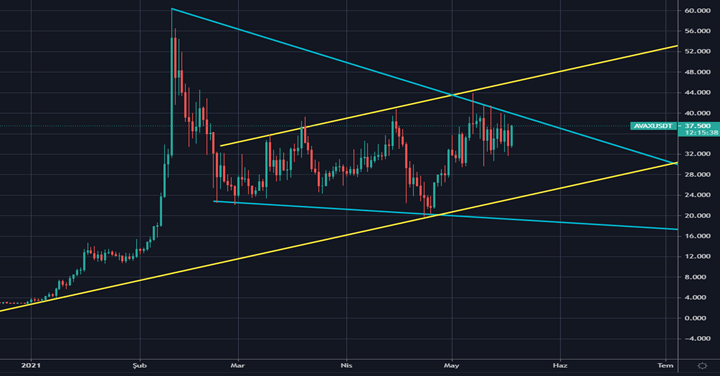

Chart 1 - Trend Analysis

AVAX, which has been progressing in the rising trend since the beginning of 2021, preserves this trend so far. It has tested the support points of the trend in 10 places. In this rising trend, a parallel resistance line was created as of the beginning of March and it has touched these resistance points at 6 points. As a second trend, it is in a downward trend since February 10, 2021 and has tested these resistance points at 6 points. The price is currently squeezed between the rising main trend and the falling secondary trend. When it approaches the main support and resistance points, its direction should be supported with the help of indicators.

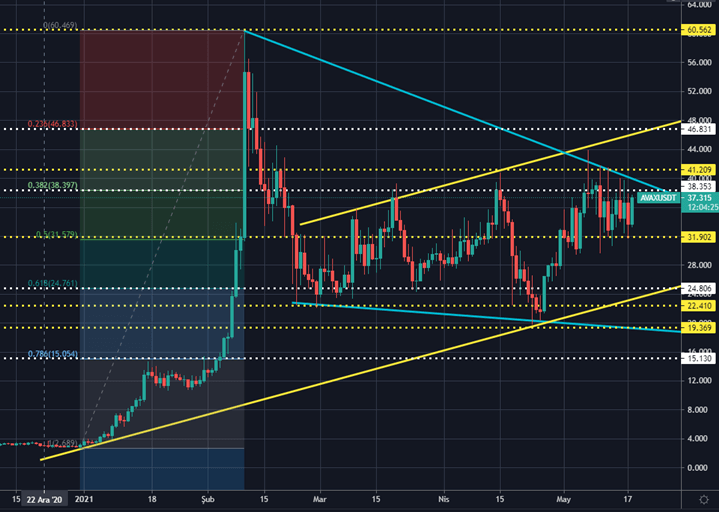

II. Support & Resistance Points & Trend Retreament

Chart 2-Support & Resistance Points & Fibonacci Retreament

We can talk about 5 main support and 4 main resistance points. Below are the main support and resistance points listed.

|

MAIN RESISTENCES |

|

|

MAIN SUPPORTS |

|

|

|

|

|

|

|

|

5.Main Resistence |

|

|

1.Fib-Main Support |

$31,58 |

|

4.Main Resistence |

$60,47 |

|

2.Fib Support |

$24,76 |

|

3.Main Resistence |

$46,83 |

|

3.Main Support |

$22,41 |

|

2.Main Resistence |

$41,21 |

|

4.Main Support |

$19,37 |

|

1.Fib Resistance |

$38,35 |

|

5.Fibonacci Support |

$15,13 |

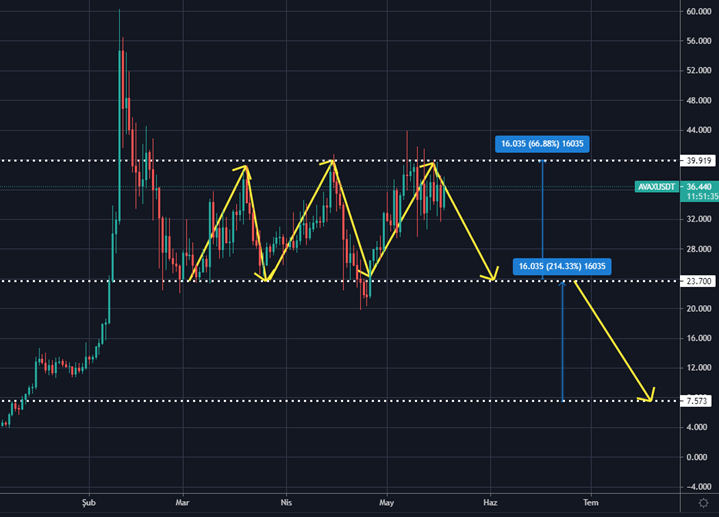

III. Formation Analysis

Chart 3-Formation Analysis

Here, a 3-peak formation occurs, but it has not yet completed its formation, if it experiences a serious volume and price decrease and breaks $ 23.70 in the opposite direction, this formation will occur and then we can expect the price to drop to $ 7.57. However, the indicators show that the probability of this formation is very low.

IV. News Perspective

Here are relevant news for AVAX:

-The Avalanche cryptocurrency, the first cryptocurrency ever to implement the Avalanche consensus, experienced an outage of service yesterday when its web wallet presented an outage that lasted for six hours. This was the consequence of severe congestion due to an airdrop carried out by AvaLaunch, leaving users without control of their funds for this period.

-Cardano founder Charles Hoskinson stated that:”You know, when you look at the third generation of cryptocurrencies, the Algorands (ALGO), the Tezos (XTZ), the Avalanches (AVAX), the Cardanos (ADA)… these projects have large teams, capital and accountability. They have the aspirations or reality of use and utility… DOGE does not have a stable development team. There is no original tech in DOGE. It’s a copy of Bitcoin…”

For more data, tools, analytics and news on Crypto Markets, register CryptoIndexSeries on cryptoindexseries.com

LATEST CIS GAZETTE ISSUES